.

- SWOT analyses are ideally performed on companies and not on markets, the justification for which is very simple. In case of companies there is a clear demarcation of the boundary that differentiates the internal factors (Strengths, Weaknesses) from the ones in the External Operating Environment (Opportunities, Threats). In a market however, there is no clear definition of an External Operating Environment and thus is hard to distinguish the strengths from the opportunities and the weaknesses from the threats.

- External Factor Evaluation (EFE), on the other hand, comes very close to tackling the issue by identifying and quantifying the EOE factors that shape and characterize the market(s), a company operates in. However, the fact remains that EFE Analyses are never performed in isolation and always follow, what is called the Internal Factor Evaluation (IFE) – the end objective being to build the Internal-External (IE) Matrix. And hence, the bias remains.

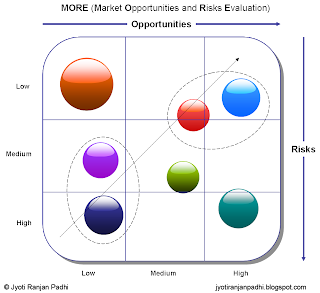

Essentially, the trick is to build a framework that does an Internal Factor Evaluation (IFE) by considering the markets as individual entities. In other words, it’s an IFE, independent of the influence of an External Operating Environment (EOE). Here I propose, what I call, MORE (Market Opportunities and Risks Evaluation).

MORE (Market Opportunities and Risks Evaluation):

MORE is a qualitative attribute based study that takes into account all the factors (Opportunities and Risks) that shape and characterize a market. Examples of market opportunities could be:

- Ease of market entry/exit

- High market growth forecasts

- High consumer demand forecasts

- Early stage of the industry in the evolutionary life-cycle

Examples of risks could be:

- Fragmented market and thus chances of loosing out to competition

- Recession sensitive – the ongoing recession might lower the spending

- Increasing demand for price reduction

- Non-reimbursable and hence sensitive to macro-economic scenario such as inflation

- Highly sensitive to technological changes

The first step in building a “MORE Matrix” involves listing out the opportunities and risks for all the markets for which a comparative attractiveness analysis is being done. The second step involves weighing the opportunities and risks independently on the basis of their relative importance to the market. The weights are then multiplied with an Impact Factor. The Impact Factor is basically a score, in a scale of 1 to 5, which measures the strength and likelihood of the opportunity/risk. What comes out of all these is a score specific to each MORE attribute (Opportunities and Risks) of a market. The opportunities and risks scores are then averaged out independently to assign a consolidated Opportunity and Risk score to each market. The scores are then plotted (Opportunities in Y-Axis and Risks in X-Axis) in a 2x2 matrix to measure and visualize the relative attractiveness of the different markets being studied.

Since the matrix, at no point, takes any particular company into consideration, it almost succeeds in delivering a neutral judgment of a market vis-à-vis another market, irrespective of who is judging it.

No comments:

Post a Comment